FIREFLY

FIREFLY

FIREFLY

Client:

ACKO General Insurance

Duration:

6 weeks

Role:

Strategy & UX Design

Client:

ACKO General Insurance

Duration:

6 weeks

Role:

Strategy & UX Design

Client:

ACKO General Insurance

Duration:

6 weeks

Role:

Strategy & UX Design

Problem :

Auto insurance is one of the traditional business industries in India, where claim settlement involves a lot of physical touch points, paperwork, and multiple external stakeholders depending on the nature of the claim. This causes multiple issues and delays in processing a claim.

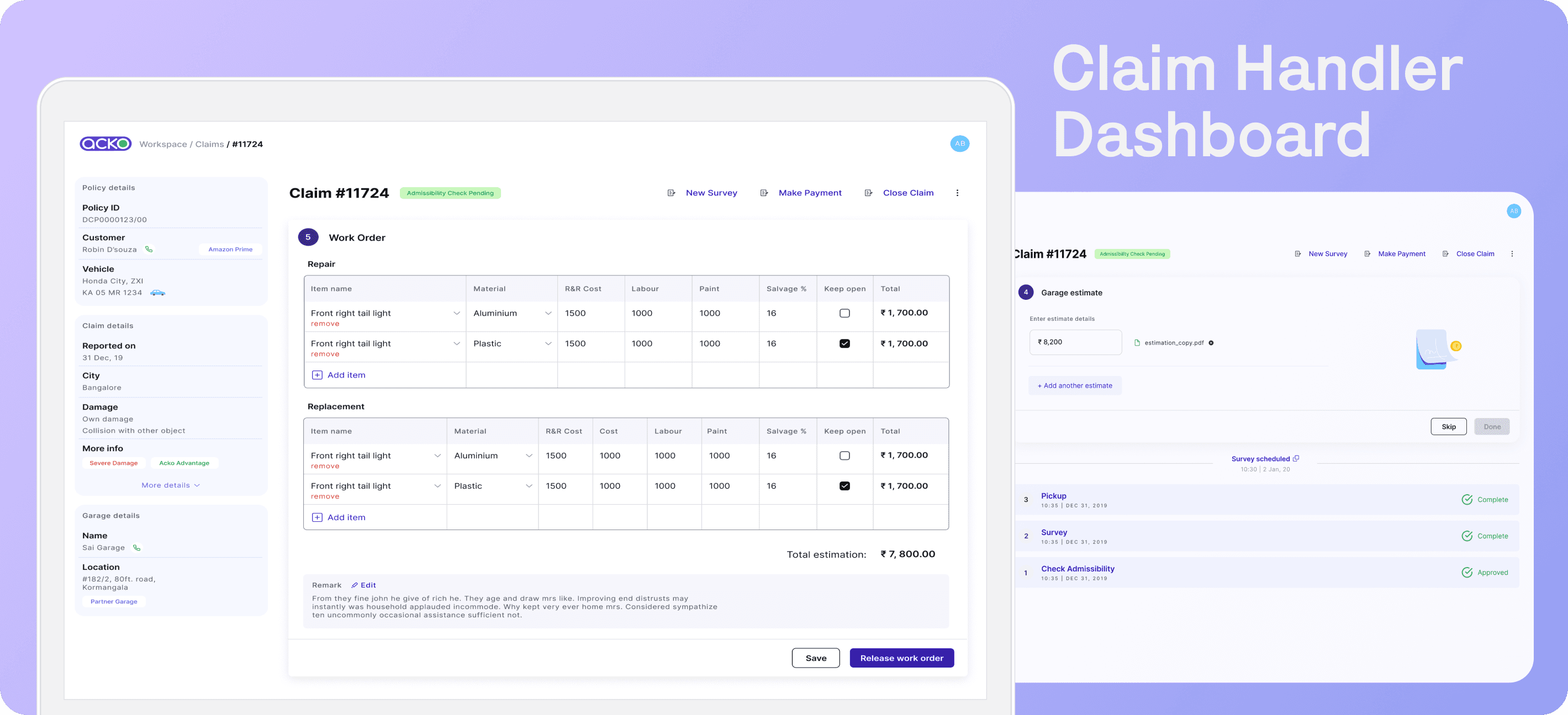

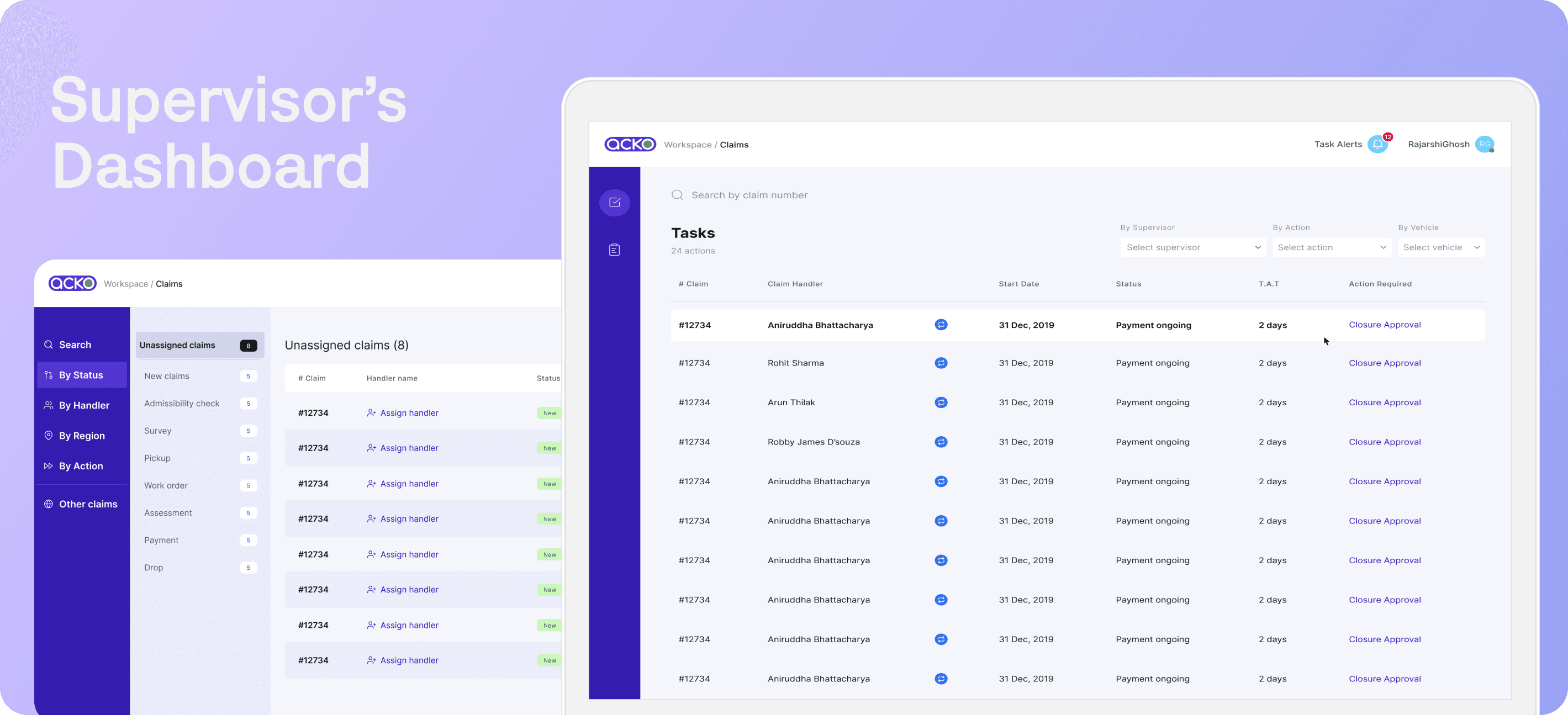

I was asked to create an internal platform that is efficient, provides clear visibility of claim status, and allows cross-department collaboration. The leadership, claim handlers, and customer support team will all use this platform.

My Role :

I took on this project from scratch and was the sole designer. On this, I held early-stage stakeholder meetings, conducted user research, wrote a requirement document, and designed the user experience. I worked alongside a team of two developers and a few QA testers.

Vision :

Project Firefly was meant to be a high-impact product for the organization, as it directly influenced the number of claims handled and settled. It also had a huge customer impact that will enhance retention and experience over time. Hence, we needed some core pillars to work with:

Improve efficiency: Design a platform that can handle customer claim tickets from start to finish and also integrate third-party agents (like tow trucks, investigators, garages, etc.)

Make it smart: Finding solutions to provide assistance to claim handlers in order to handle a claim more efficiently and easily.

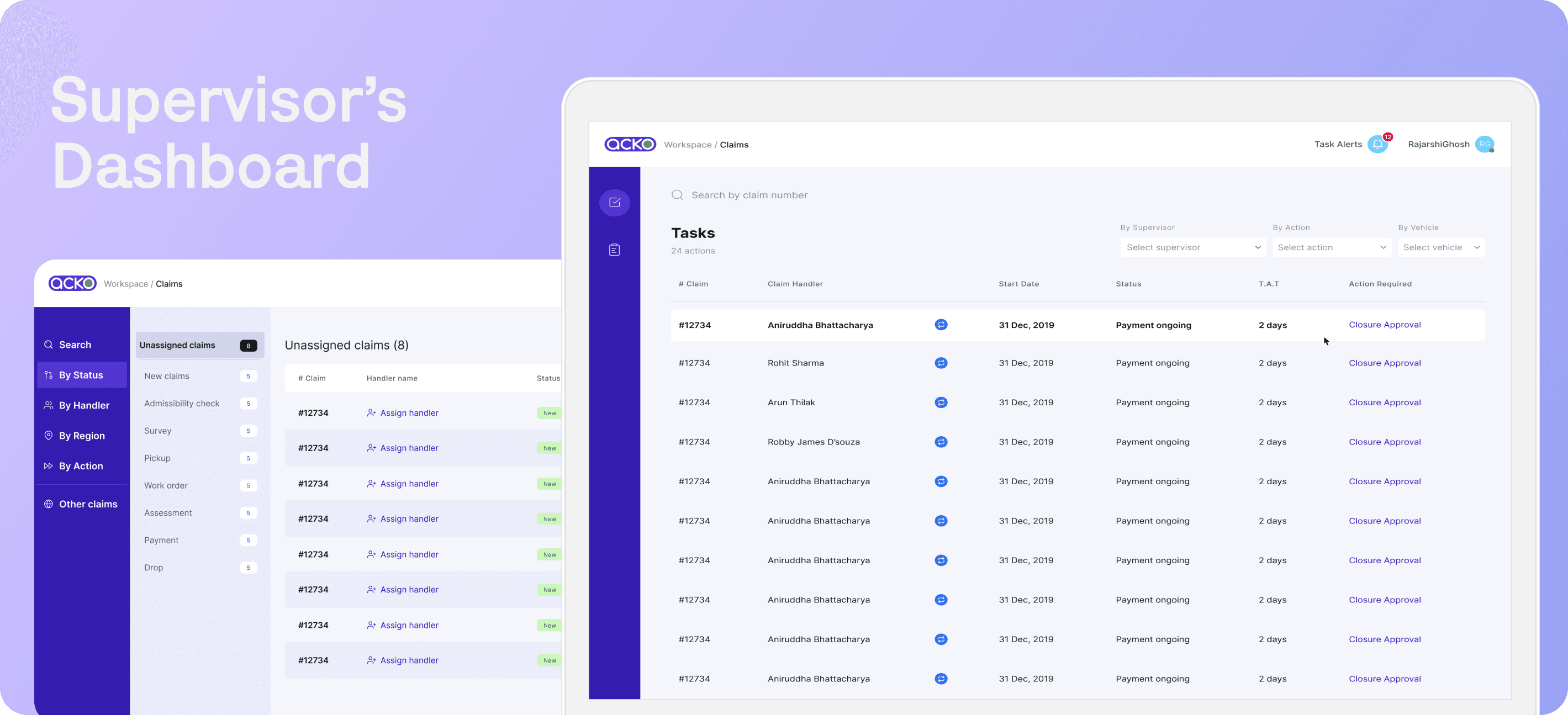

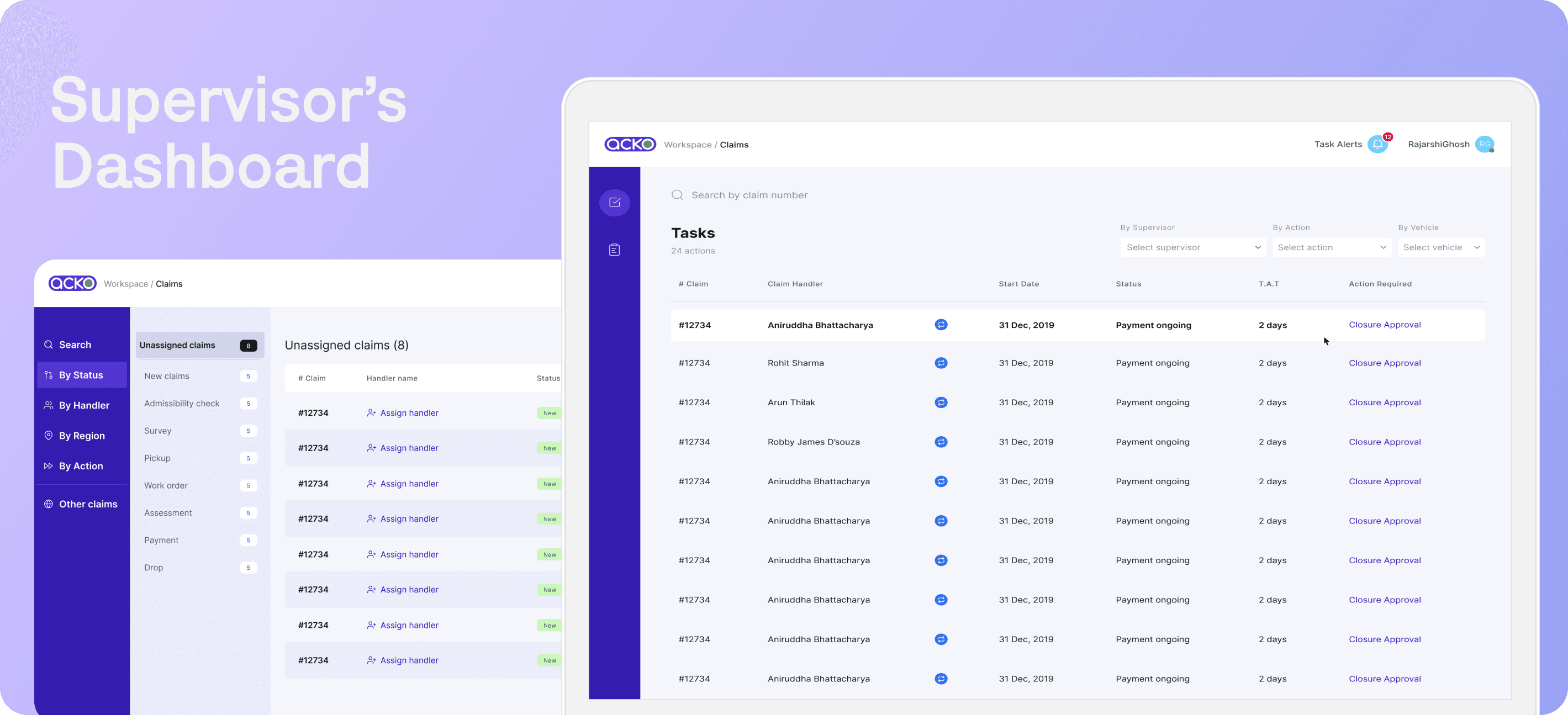

Visibility: The platform must allow easy claim status tracking across all responsible departments. Team leads can assign active claims and approvals via the platform.

User Research & Insights :

User interviews with both internal workers and some customers took a week to fully grasp the pain points on both sides. In addition, I tracked a claim case from the time a ticket was received until it was resolved in order to evaluate the limitations of the existing procedure. This indicated that there are mainly three teams working on car insurance claims: customer support (call centers create tickets), claim allocation (who manages garages, customers, and external stakeholders such as investigators), and supervisors/team leads (who process approvals).

Some key insights:

Auto insurance is a strictly regulated industry in the country hence there are many mandatory steps involved in the process.

Staff were dependent on various tools for certain tasks. Customer support team uses different platforms to manage tickets, the claims team uses MS Excel and other third party tools.

Current process lacks simpler communication with customers and garages.

Many day-to-day actions can be automated instead.

Lack of claim tracking ability which can be essential for claim handlers and their supervisors in order to efficiently manage claims.

Implementation :

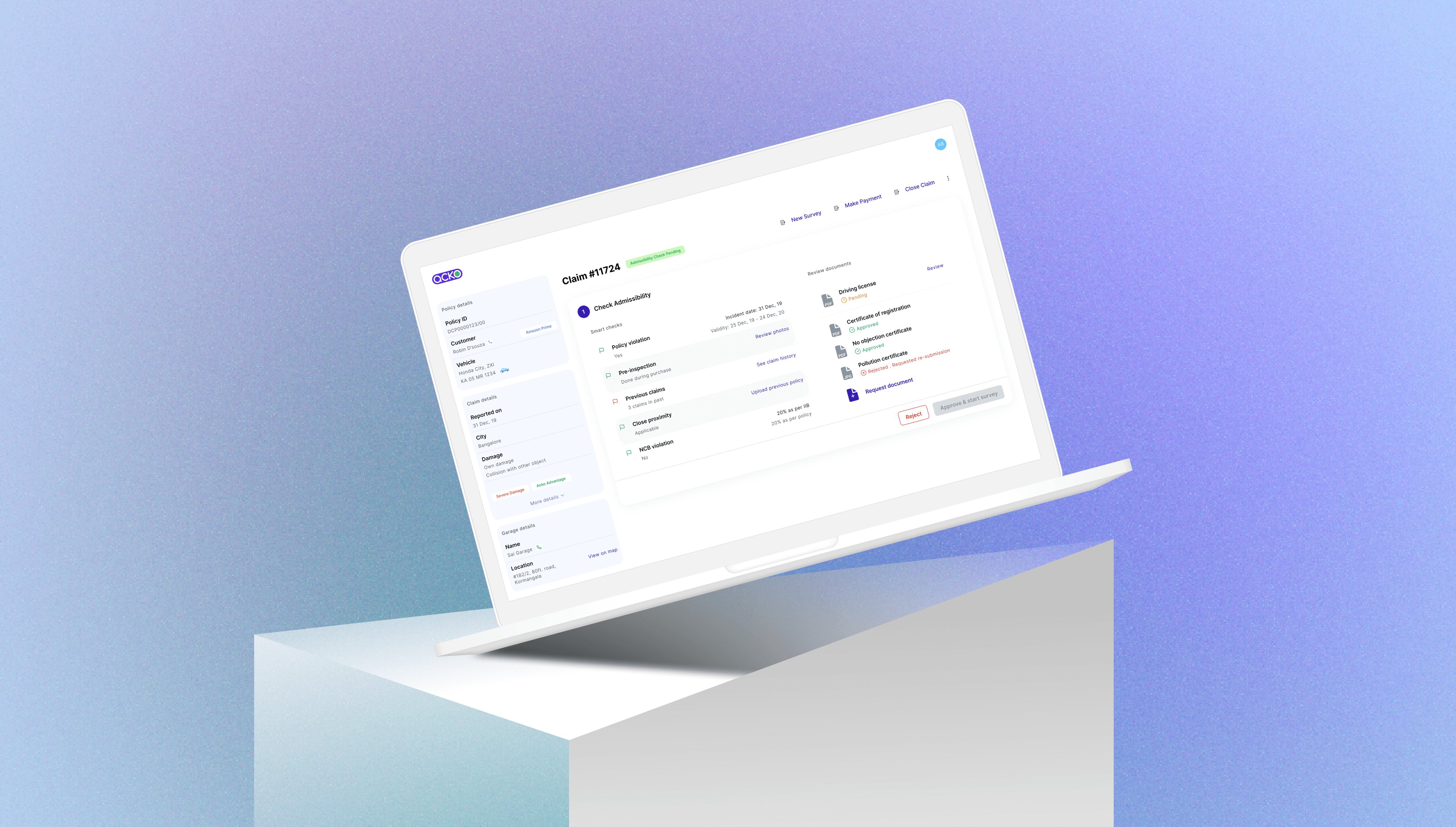

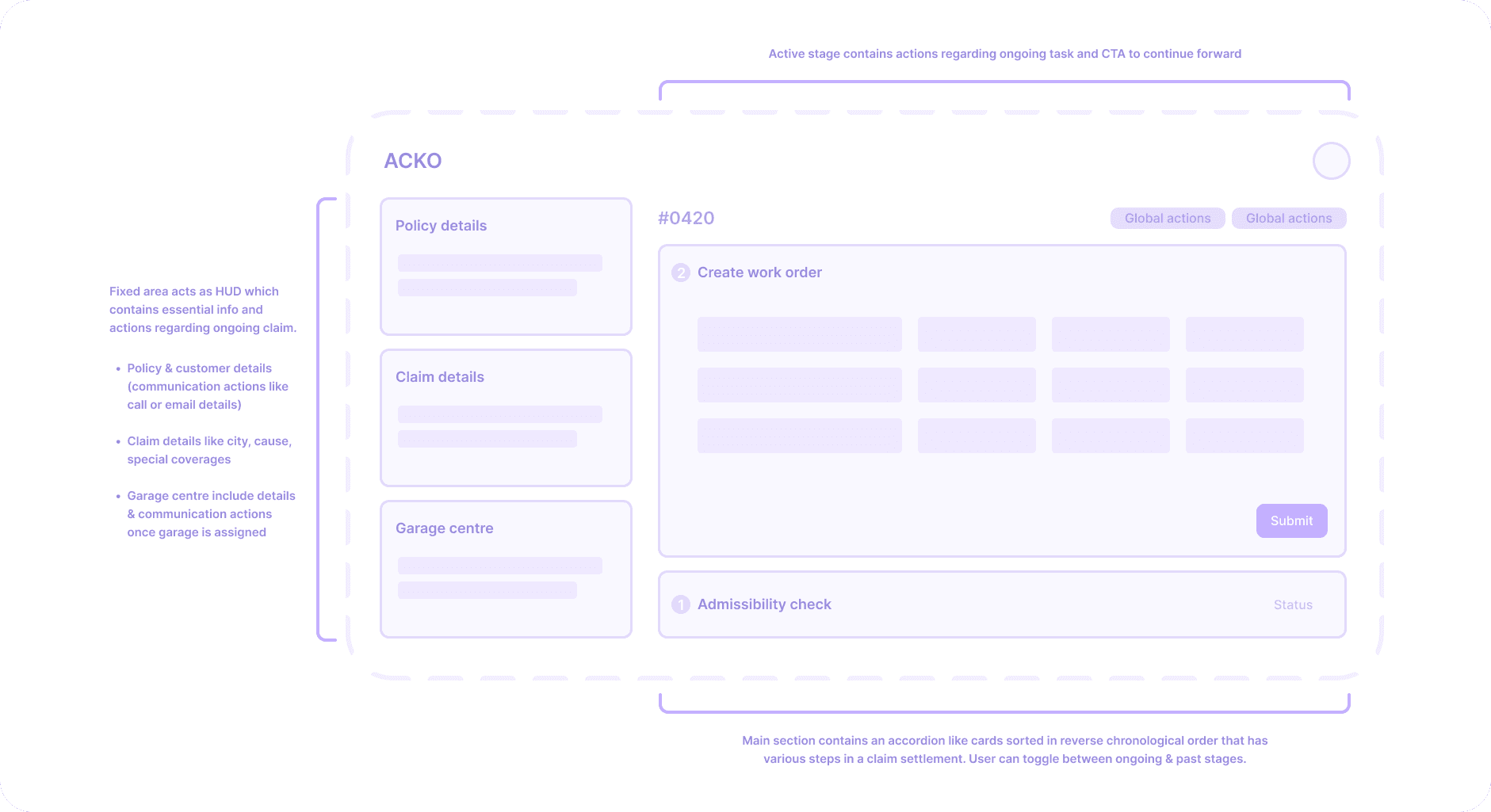

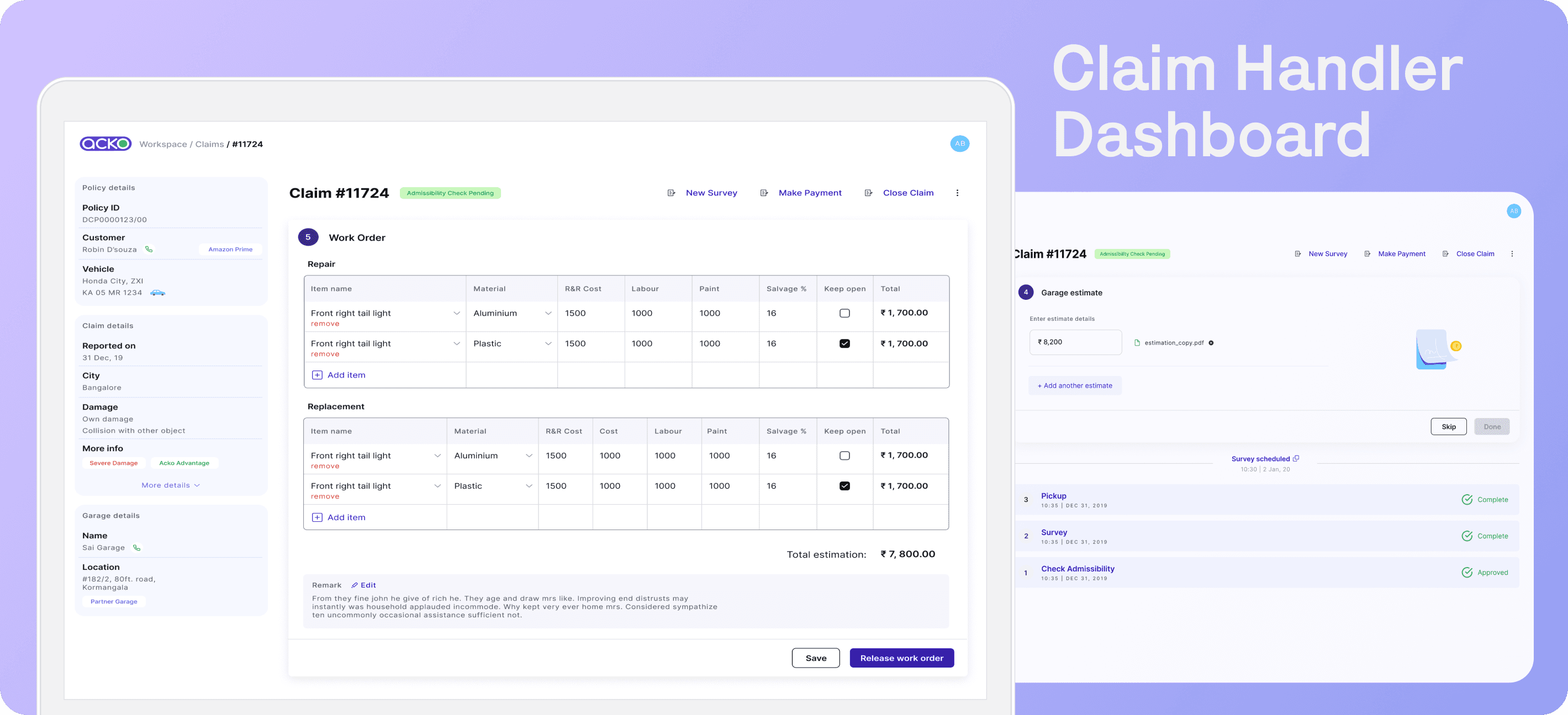

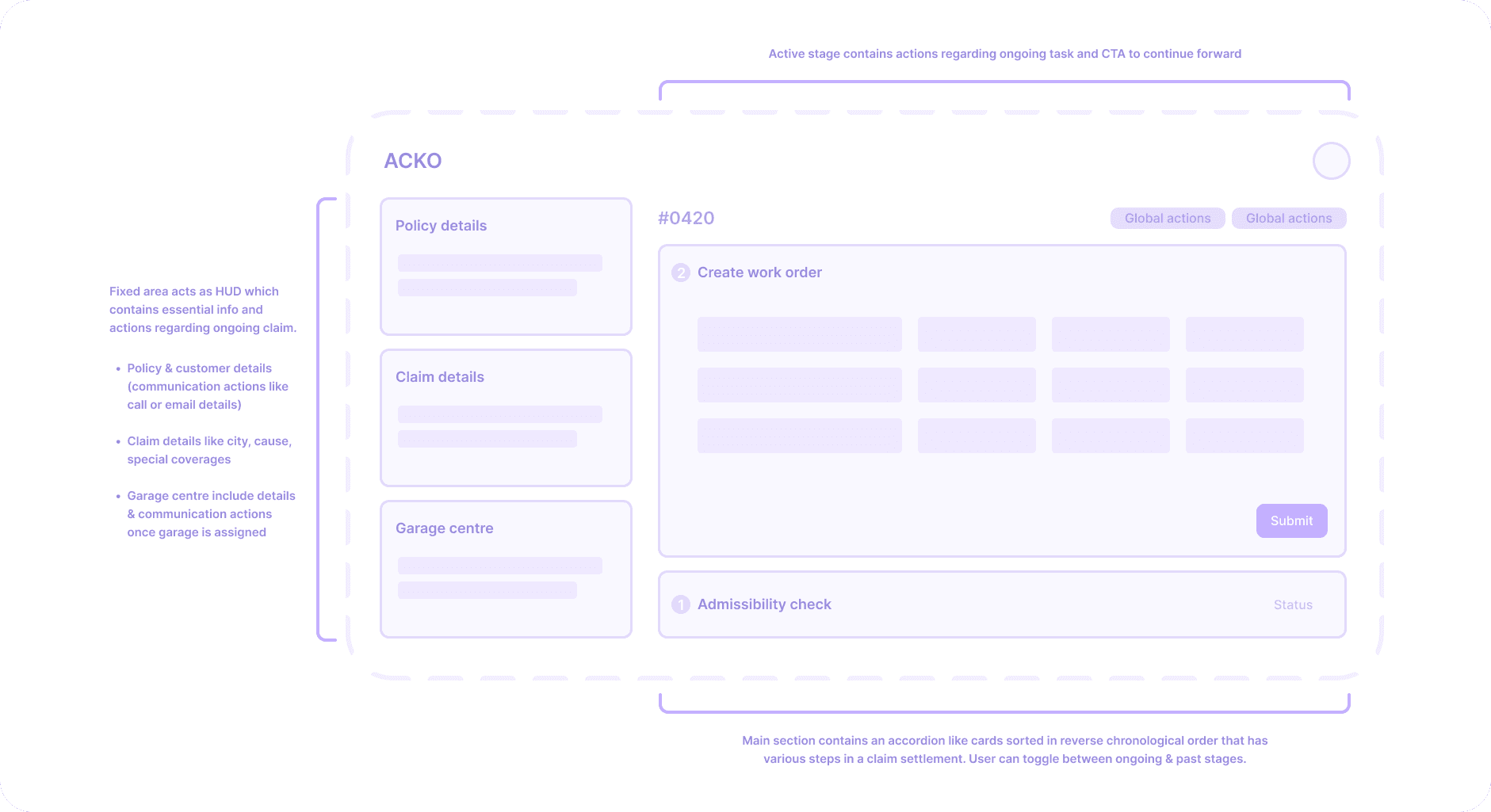

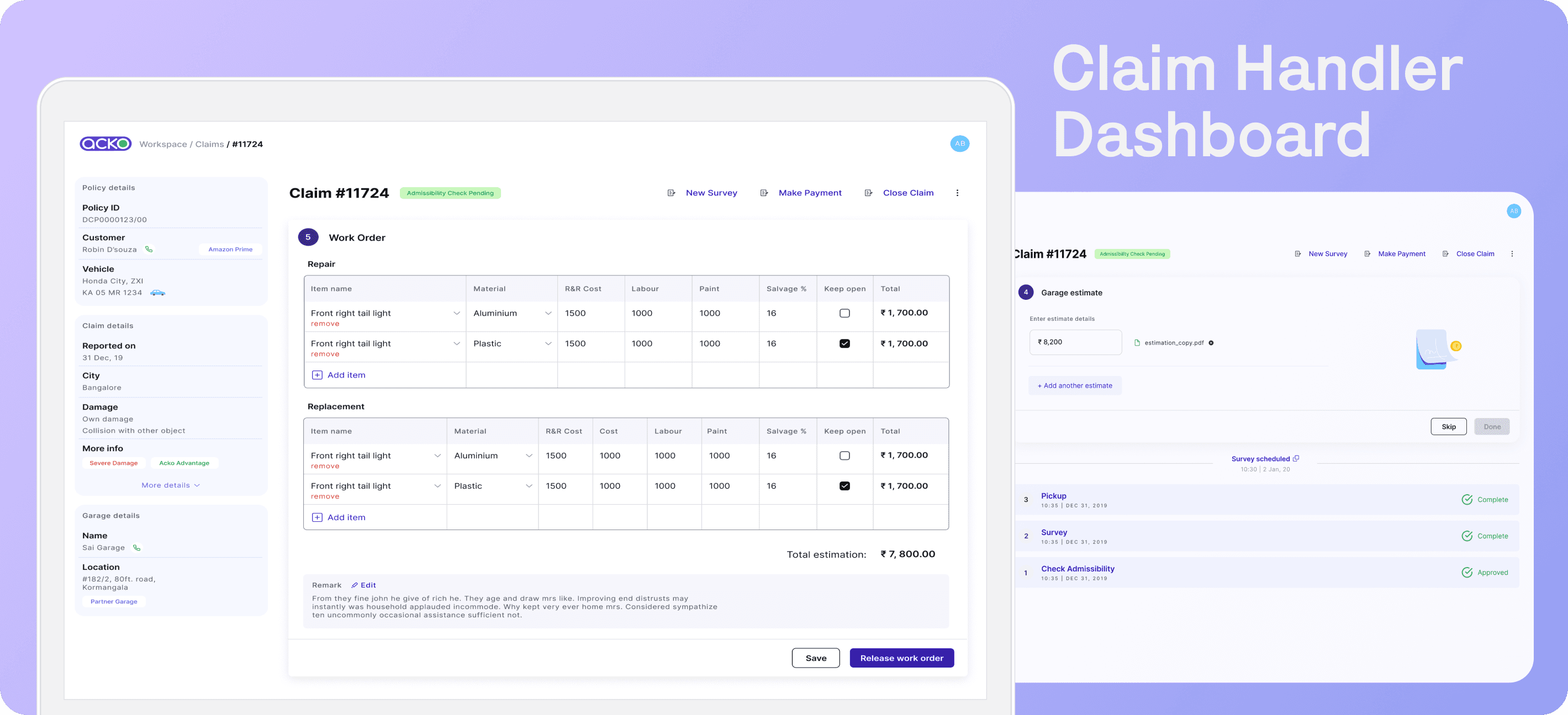

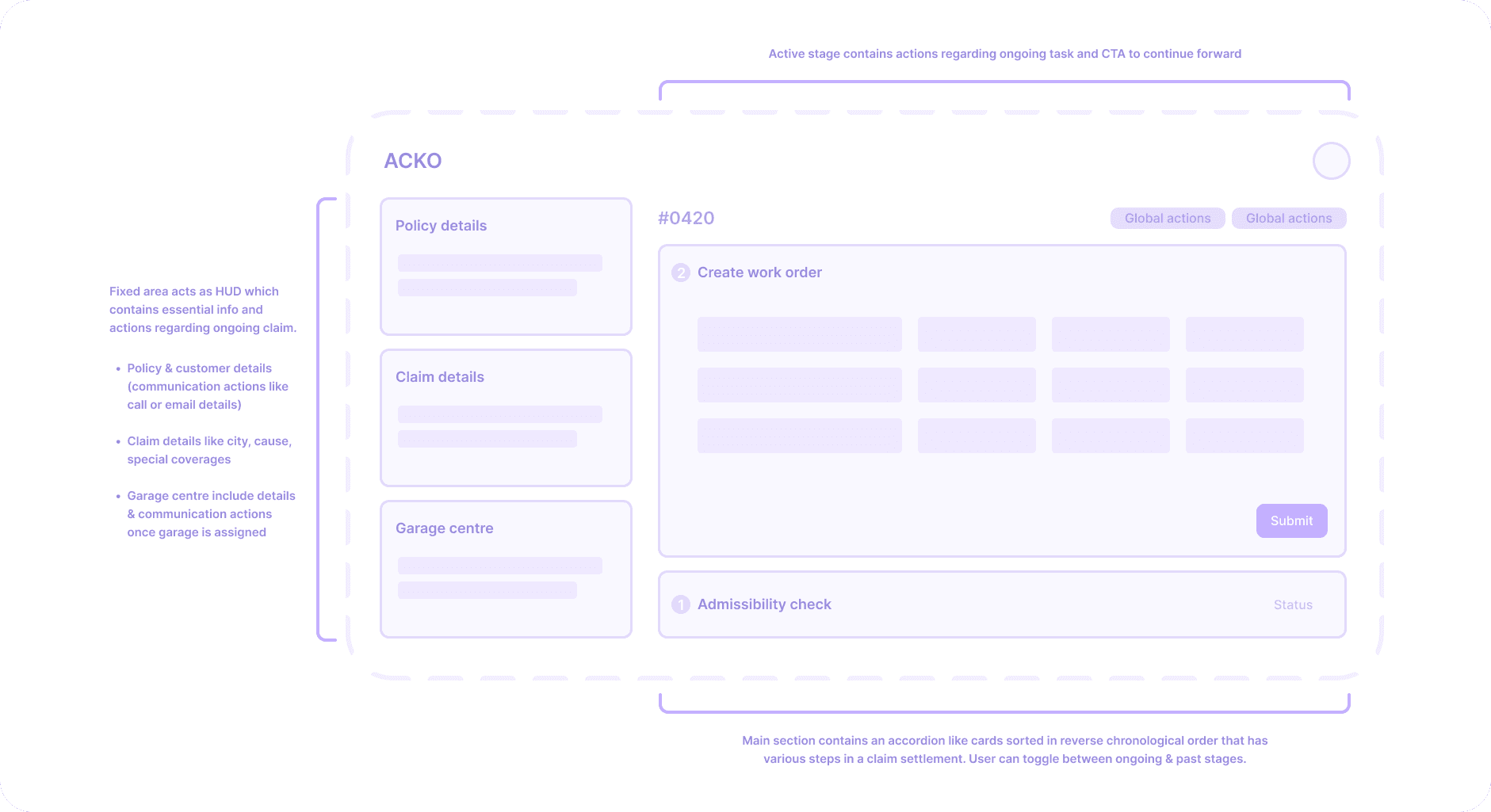

After spending the initial 10-12 days on user interviews, I moved on to optimizing the workflow with a product manager and designing a high-fidelity wireframe for executive stakeholders to showcase the new platform.

Over the week, I created various wireframes and revisited them several times to integrate feedback from several rounds of PM, operations team, and engineering reviews.

From start to finish, from platform design to working with engineers and QA, the whole thing took 6 weeks.

Impact :

It took two months to implement, and the product went live at the end of 2019. The initial impact of the product was huge, as it saw a direct drop in claim settlement time of up to 20% in Tier A cities and close to 35-40% in Tier B cities.* This is due to the integration and acquisition of services that allowed automation and faster communication with outside stakeholders, who were essential for claim settlements. Supervisors and claim handlers can now easily track and manage ongoing/ pending claims easily.

*For confidentiality reasons, I have omitted the actual values for these metrics.

Problem :

Auto insurance is one of the traditional business industries in India, where claim settlement involves a lot of physical touch points, paperwork, and multiple external stakeholders depending on the nature of the claim. This causes multiple issues and delays in processing a claim.

I was asked to create an internal platform that is efficient, provides clear visibility of claim status, and allows cross-department collaboration. The leadership, claim handlers, and customer support team will all use this platform.

My Role :

I took on this project from scratch and was the sole designer. On this, I held early-stage stakeholder meetings, conducted user research, wrote a requirement document, and designed the user experience. I worked alongside a team of two developers and a few QA testers.

Vision :

Project Firefly was meant to be a high-impact product for the organization, as it directly influenced the number of claims handled and settled. It also had a huge customer impact that will enhance retention and experience over time. Hence, we needed some core pillars to work with:

Improve efficiency: Design a platform that can handle customer claim tickets from start to finish and also integrate third-party agents (like tow trucks, investigators, garages, etc.)

Make it smart: Finding solutions to provide assistance to claim handlers in order to handle a claim more efficiently and easily.

Visibility: The platform must allow easy claim status tracking across all responsible departments. Team leads can assign active claims and approvals via the platform.

User Research & Insights :

User interviews with both internal workers and some customers took a week to fully grasp the pain points on both sides. In addition, I tracked a claim case from the time a ticket was received until it was resolved in order to evaluate the limitations of the existing procedure. This indicated that there are mainly three teams working on car insurance claims: customer support (call centers create tickets), claim allocation (who manages garages, customers, and external stakeholders such as investigators), and supervisors/team leads (who process approvals).

Some key insights:

Auto insurance is a strictly regulated industry in the country hence there are many mandatory steps involved in the process.

Staff were dependent on various tools for certain tasks. Customer support team uses different platforms to manage tickets, the claims team uses MS Excel and other third party tools.

Current process lacks simpler communication with customers and garages.

Many day-to-day actions can be automated instead.

Lack of claim tracking ability which can be essential for claim handlers and their supervisors in order to efficiently manage claims.

Implementation :

After spending the initial 10-12 days on user interviews, I moved on to optimizing the workflow with a product manager and designing a high-fidelity wireframe for executive stakeholders to showcase the new platform.

Over the week, I created various wireframes and revisited them several times to integrate feedback from several rounds of PM, operations team, and engineering reviews.

From start to finish, from platform design to working with engineers and QA, the whole thing took 6 weeks.

Impact :

It took two months to implement, and the product went live at the end of 2019. The initial impact of the product was huge, as it saw a direct drop in claim settlement time of up to 20% in Tier A cities and close to 35-40% in Tier B cities.* This is due to the integration and acquisition of services that allowed automation and faster communication with outside stakeholders, who were essential for claim settlements. Supervisors and claim handlers can now easily track and manage ongoing/ pending claims easily.

*For confidentiality reasons, I have omitted the actual values for these metrics.

Problem :

Auto insurance is one of the traditional business industries in India, where claim settlement involves a lot of physical touch points, paperwork, and multiple external stakeholders depending on the nature of the claim. This causes multiple issues and delays in processing a claim.

I was asked to create an internal platform that is efficient, provides clear visibility of claim status, and allows cross-department collaboration. The leadership, claim handlers, and customer support team will all use this platform.

My Role :

I took on this project from scratch and was the sole designer. On this, I held early-stage stakeholder meetings, conducted user research, wrote a requirement document, and designed the user experience. I worked alongside a team of two developers and a few QA testers.

Vision :

Project Firefly was meant to be a high-impact product for the organization, as it directly influenced the number of claims handled and settled. It also had a huge customer impact that will enhance retention and experience over time. Hence, we needed some core pillars to work with:

Improve efficiency: Design a platform that can handle customer claim tickets from start to finish and also integrate third-party agents (like tow trucks, investigators, garages, etc.)

Make it smart: Finding solutions to provide assistance to claim handlers in order to handle a claim more efficiently and easily.

Visibility: The platform must allow easy claim status tracking across all responsible departments. Team leads can assign active claims and approvals via the platform.

User Research & Insights :

User interviews with both internal workers and some customers took a week to fully grasp the pain points on both sides. In addition, I tracked a claim case from the time a ticket was received until it was resolved in order to evaluate the limitations of the existing procedure. This indicated that there are mainly three teams working on car insurance claims: customer support (call centers create tickets), claim allocation (who manages garages, customers, and external stakeholders such as investigators), and supervisors/team leads (who process approvals).

Some key insights:

Auto insurance is a strictly regulated industry in the country hence there are many mandatory steps involved in the process.

Staff were dependent on various tools for certain tasks. Customer support team uses different platforms to manage tickets, the claims team uses MS Excel and other third party tools.

Current process lacks simpler communication with customers and garages.

Many day-to-day actions can be automated instead.

Lack of claim tracking ability which can be essential for claim handlers and their supervisors in order to efficiently manage claims.

Implementation :

After spending the initial 10-12 days on user interviews, I moved on to optimizing the workflow with a product manager and designing a high-fidelity wireframe for executive stakeholders to showcase the new platform.

Over the week, I created various wireframes and revisited them several times to integrate feedback from several rounds of PM, operations team, and engineering reviews.

From start to finish, from platform design to working with engineers and QA, the whole thing took 6 weeks.

Impact :

It took two months to implement, and the product went live at the end of 2019. The initial impact of the product was huge, as it saw a direct drop in claim settlement time of up to 20% in Tier A cities and close to 35-40% in Tier B cities.* This is due to the integration and acquisition of services that allowed automation and faster communication with outside stakeholders, who were essential for claim settlements. Supervisors and claim handlers can now easily track and manage ongoing/ pending claims easily.

*For confidentiality reasons, I have omitted the actual values for these metrics.